- Collection and Disbursement

Potentials and opportunities of a system rebuild

Why it makes sense for insurers to set up and automate existing collection and disbursement systems in a forward-looking way

- •

- Claudia Buder

– Abstract

Automated, customer-oriented risk and receivables management is a prerequisite to enable insurers to use their own data far more intensively

Data is the preeminent resource of the insurance industry. New IT systems bring insurance companies closer to their customers and keep them competitive in the future. One of the prerequisites for this is automated, customer-oriented risk and receivables management. The majority of insurers believe they are well positioned for the future when it comes to modernizing their IT landscape, implementing and using it. This is the conclusion of the Lünendonk study Digital Outlook 2025 - Financial Services. Nevertheless, the study warns: Rapidly changing customer requirements should not be underestimated, nor should the speed of innovation, especially from technology companies, which are driving the market ahead of them.

– Fast Lane

In this article you will learn:

- What a well thought-out system configuration is all about (video)

- 7-point checklist: How insurers benefit from Collections and Disbursements solutions - and what makes these solutions smart

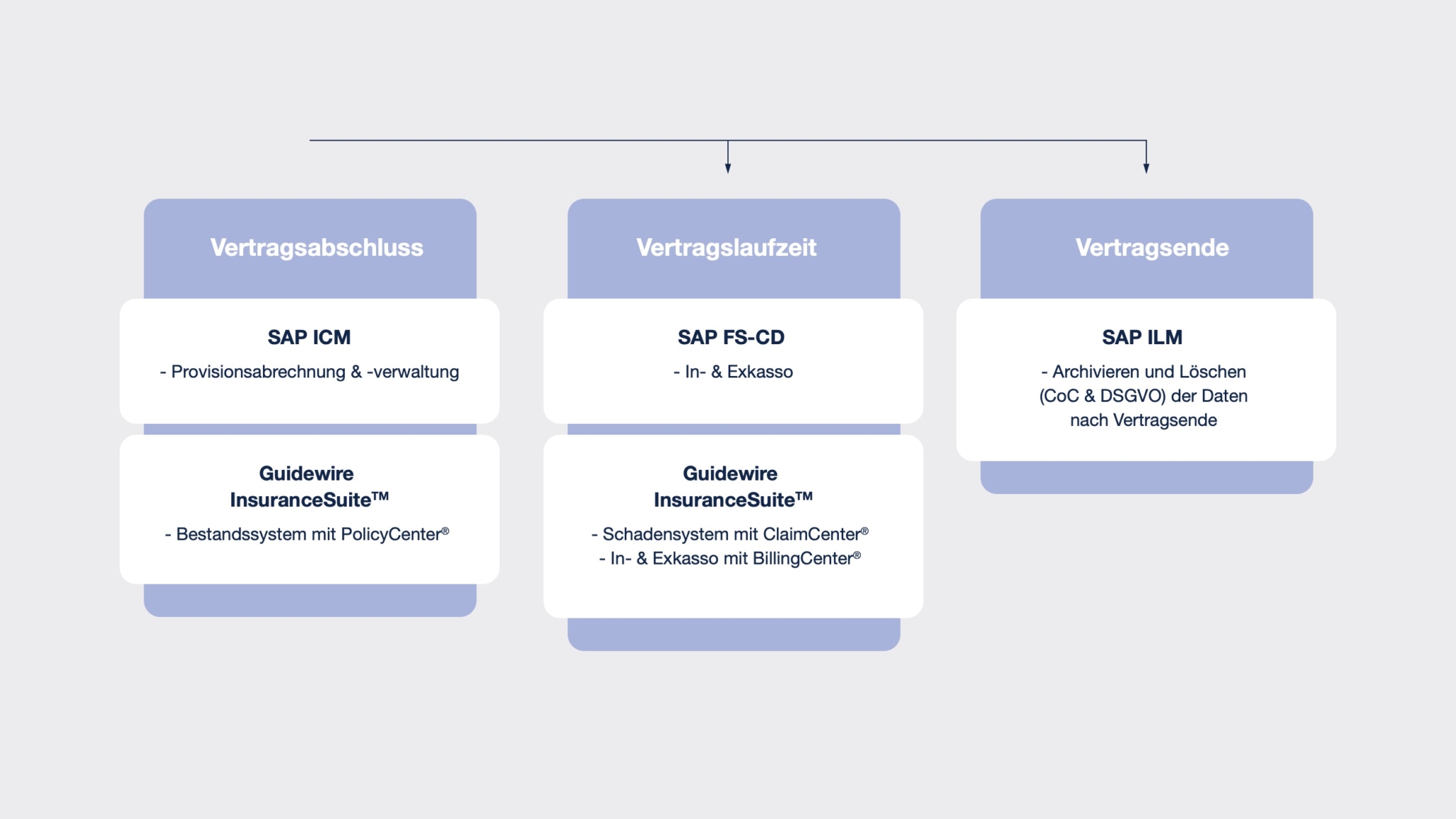

- Which SAP and Guidewire modules make sense along the contract lifecycle

- Conclusion: Once processes are defined, they can be saved, copied, shared, and modified.

"Those who set up a professionally and technically consolidated procedure for all processes for Collection and Disbursement will avoid media discontinuities in the future"

These changes pose major challenges for accounting departments. A new, process-optimizing collection and disbursement system presupposes that Performance and system limits are analyzed and Opportunities are recognized. And that organizations recognize their opportunities.

The good news is: Many insurers already have knowledge in financial accounting. This reduces the effort required to draw synergies from smart and automated receivables management.

Two core systems in total that come into question: SAP FS-CD and Guidewire. Should the step towards comprehensive automation and digitization be a larger one, intelligent platform and process solutions exist here as well. For example, receivables management can be automated with

- Offers

- Inventory

- Damage system fit for the future.

Best practice: A well thought-out example configuration is based on a modular system and is as easy to handle as Lego bricks.

"For insurance companies, it is essential that they achieve a convincing benefit with a manageable effort when introducing new software," says Sascha Koch, Crew Lead Subledger Accounting at IKOR. The SAP FS-CD subledger accounting system is ideal for this purpose, as it has proven itself around the world and is used by insurance companies with fewer than 100 employees and international insurance groups. It covers all collection and disbursement business transactions as standard. It is flexibly configurable, has the customer and their needs firmly in mind, and also pays attention to the company's goals.

This is particularly important when it comes to outstanding contributions on the part of the customer, whether they are partially paid or unpaid. "With SAP FS-CD, the desired dunning procedures can be determined, the respective time intervals defined and the resulting activities set with little effort and without programming,"says Jochem Schültke, Solution Architect & Senior Expert at SAP.

This is how insurers benefit

1 Develop processes from a single source

Those who set up a technically consolidated process for all incoming and outgoing cash transactions will avoid media discontinuities in the future. In legacy system landscapes, the processing of business transactions was often accompanied by a system change. Insurers who can avoid these system changes or the media discontinuities that often accompany them, bundle the applications "seamlessly" in one system from the user's perspective. This both reduces the need for different technical knowledge and facilitates the work of departmental staff.

2 Adapt payment configurations/modalities specifically and quickly

Employees must be able to enter payment settings ad hoc, conveniently and without programming knowledge, or to change and set them to suit the customer situation. For example, with regard to temporary payment difficulties of a valuable customer during the Corona pandemic. This also makes it possible to intervene manually in various standard processes if necessary and to suspend a dunning procedure once in a while in order to save fees and retain the customer in the longer term.

3 Increase the scope of services

Employees can display incoming payments on their front end and reconcile them directly in customer meetings. In addition, large insurers have the option of establishing efficient receivables management and thus also integrating late fees or interest in the event of a late payment into the commercial dunning process.

IKOR + SAP + GUIDEWIRE

Customer Lifecycle

IT and business processes in focus: In contrast to individual software, the SAP standard is designed for an open and flexible and process-oriented IT landscape. Guidewire and SAP FS-CD are the modules used for contract conclusion and contract term. SAP FS-CD is the benchmark for automated collection and disbursement.

Effects on finance and accounting include SAP FI and interfaces such as SAP BMC and SAP AIF, etc. The implementation can be supported with SAP S/4 Hana and SAP Fiori.

4 Increase the allocation rate of incoming payment

This increases the automated processability ("dark processing") to more than 90 percent. If direct debit authorizations are available, this proportion is even higher.

Example:

Example

Before

Incorrect remittance slip or debit authorization. In the worst case, unjustified reminders are issued or a credit note is issued.

After

Software checks corrections and automatically assigns future cases. At the same time, customer satisfaction is increasing because discrepancies that would previously have caused correspondence with customers or internal manual processing are occurring less frequently or not at all.

5 Increase posting logic

By converting to an open item view, accounting reconciliation and also traceability is improved.

6 UX Smart processes minimize the workload for administrators

And provide new opportunities to deploy second- and third-level resources and system maintenance in a more targeted manner. User-friendly frontends can make it noticeably easier for employees to use the system. This includes user-friendly interfaces, improved screen resolution and intuitive arrangements. Maintenance is also improved because fewer manual interventions are required and then only on an interface optimized for employees. In the case of a complete system changeover, there is no need to switch between different (old) systems ("legacy").

7 Ensure that the system adheres to (legal) compliance rules

Modern collection and disbursement systems allow collection and disbursement processes to be flexibly adapted to ever-changing market and legal requirements. In the case of the SAP core system (SAP FS-CD), adjustments (such as enhancements / add-ons, new apps, or up-to-date payment systems) can be made effectively. This not only helps insurers to concentrate on their core tasks with their own resources, but also to integrate future product innovations.

– Conclusion

Once processes are defined, they can be saved, copied, shared, and modified.

Automated receivables management opens up better options for Insurer collections and disbursements, a more flexible collection process and stronger customer loyalty. As a partner of SAP FS-CD, IKOR offers pertinent sample configurations, modularly designed, and continuously evolving. The best-practice modular system is based on automated standard processes. It enables insurers to implement them more easily and in a way that is easy to manage. Once processes have been defined, they can be saved, copied, shared, and modified at a later date using the building block principle.

Contact Person

Claudia Buder

Manager, Functional Consulting

Dock Assurance

assurance@ikor.one

+49 40 8199442-0

"The best-practice modular system is based on automated standard processes"